Demand for cyber insurance increases with digitalisation

The pandemic has changed many things during the past year, such as the ways we shop, learn, and work, but it has also changed the shape of the cyber risk landscape.

E-commerce is booming, retailers are shifting to digital platforms, and schools and offices have adapted to remote learning and working. In S&P Global Ratings' view, these digitalisation trends are here to stay and will inevitably lead to a higher likelihood of cyber incidents.

Financial services giant S&P Global (S&P)’s latest report found that the demand for cyber re/insurance coverage has increased significantly, mainly because of a heightened and rising awareness of cyber risks. The pandemic exacerbated the huge cyber reinsurance protection gap by causing existing and new clients to request larger limits and more inclusions in their policies' terms and conditions.

In addition, some insurers are offering more advanced services, including value-added assistance services.

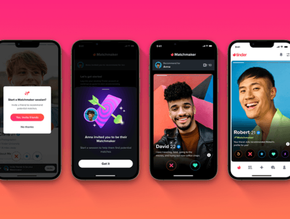

As people shift to digital solutions cyber insurance becomes key

With the sharp rise in digitalisation, the report predicts a rise in prices in the cyber re/insurance market between 2021 and 2023 as it expects insurers to continue restructuring their cyber insurance offerings, including increasing rates and adjusting their T&Cs, particularly the exclusions.

Some insurers might also further reduce their payout limits, especially where contracts include ransomware or business interruption components.

“The market faces increasing demand, but limited supply. In our opinion, lack of capacity could be holding back the development of a sustainable cyber re/insurance market,” the report said.

Reinsurers have taken on an even more important role in the cyber insurance ecosystem over the past two years. They provide cyber security, share underwriting knowledge, give actuarial support, and help managing accumulation risk, in addition to enabling the pure risk transfer. Providing cyber services could increase the value and relevance of the policy for clients.

“The reinsurance industry has been further improving its dataset by collecting information based on the coverage it provides to the primary insurance market. This helps it enhance its value proposition. Therefore, we expect reinsurers to play a major role in cyber risk management and in providing adequately priced protection,” adds the report.